A Framework for Market Worldview Alignment and Growth

Aligning your business to your market’s worldview costs very little because there’s nothing to buy, no people to hire, no new products to develop. You adjust what you have today to how your market thinks, resulting in lower customer acquisition costs and increased customer value.

The process of getting there can be simple. You can perform a reasonably quick evaluation to see if there is an interesting solution for your business. This framework will guide you, and I’ll point out shortcuts to speed things up along the way.

The three steps are Assessment, Opportunity, and Alignment. You assess your business and market for worldview skews. Then you explore the overall alignment through a series of strategic questions. Once you answer these questions and uncover opportunities, you align elements across your business to your market. The result is an intentional strategy that enables your business to think like your market.

Assessment

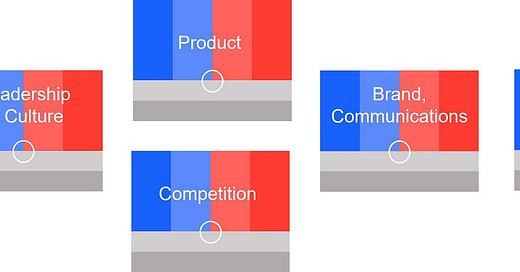

The first step is to look at the most critical elements of your business for worldview skew. This chart shows the most typical elements: leadership and culture, product, competition, brand and communications, market, and customers. You may have others. For example, if you work in a larger organization, you may want to consider business partners - retail organizations, management consulting firms, product design firms, communications agencies, and more. In the beginning, though, keep it simple.

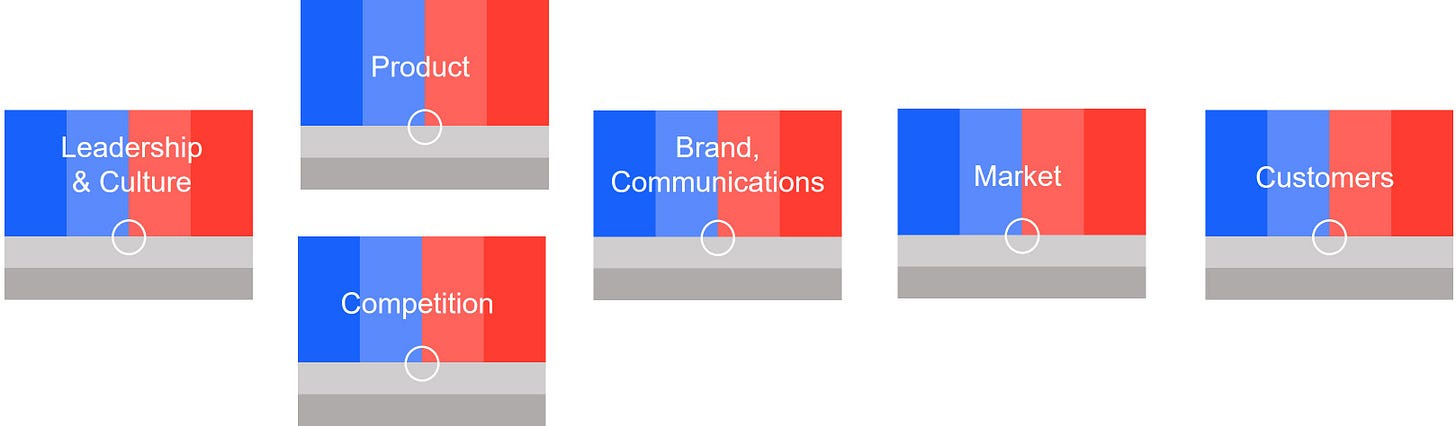

To assess each business area, use the customer model developed in a previous article. It includes themes that will help with the assessment. Here it is for your reference:

The idea here is to mark in each assessment box where you think the predominant worldview is. You can sketch out your own boxes and just put an “x” where you believe the skew is. Use clear evidence everywhere you can rather than gut instinct. You want to avoid having your own biases influence the outcome.

The spectrum from left to right is pretty straightforward. There are four areas: two blue and two red for liberal and moderate liberal plus moderate conservative and conservative. Where it can get a little tricky is with the Individualist foundation that spans both groups. If this makes it too confusing, then focus on the left and right elements.

Once you start using this framework, you may see elements that have an Individualist skew, in which case you can place the mark lower on the chart whether it’s on the left or right sides. Your placement doesn’t have to be exact - you just need to start recording skews. You can adjust them as you gather input.

Here are some guidelines for assessing each element:

Leadership and Culture This one is straightforward and perhaps tricky. Depending on where you are in the organization, declaring leadership to have a more liberal or conservative worldview may or may not be something you want to do. Yet this is critical because leadership creates culture, and culture often projects onto your market through product and communications, creating potential misalignment with a market.

“Leadership” can mean the CEO or a broader leadership team. If the CEO is the founder, you want to focus on that person as they will have an outsized influence on culture. Keep politics out of it by focusing on worldview. Stay away from “Republican” or “Democrat” and focus on the concepts of “conservative” and “liberal.” You may use voting as a proxy for worldview, but the result should be worldview. There are examples of assessing leadership in a previous article about three different cryptocurrency exchanges.

Product. Depending on the product, this element can be the most difficult to assess. The idea is to think about the product itself as having an inherent worldview skew. You can identify worldview skew in design, construction, or the problem it solves. You can find examples of product design skews in a previous article. If you have trouble evaluating your product for a worldview skew, just peg it as neutral where the mark is now in the center. Later you can run simple surveys to determine if a product or product feature resonates more with liberal or conservative customers.

Competition. This element is important because it may reveal interesting opportunities when you get to the next step in the process. Choose no more than three competitors to keep it simple. You can look at leadership and communications when pegging the competitors to the charts.

You can search on the CEO of each organization to reveal their worldview skew using such things as the organizations they belong to or donations they make. You can even use resources like FEC.gov to look for CEO political contribution history. For communications, look at the websites' home pages, TV spots on YouTube if they run TV ads, and any other communication you can put your hands on. Look at the communications with the themes from the customer model.

Brand, Communications. If your organization has a “brand brief” or “brand guidelines,” look at those documents for themes that align one way or the other using the customer model. Look at your website - the themes, images, and selling propositions. Look at PR strategy and where you pay for advertising media if those are important communications components. Look at recurring communications with customers, such as CRM emails. If your role is developing communications or brand strategy, you may want to have someone outside of your area provide feedback in case you are too close to it.

Market. Getting a read on market worldview is sometimes easy, sometimes not. You often have to use proxies for market worldviews, such as overall age and urbanicity with splits in gender. If your market is younger and more urban, you can peg it as more liberal. If it’s more male and older, it’s probably more conservative. Using these attributes isn’t perfect, but it’s better than nothing.

You can also look for third-party research to help. For example, in a previous article evaluating the market for cryptocurrency exchanges, I found evidence from Morning Consult that the market was primarily male and millennial. I then combined that information from Pew to determine this group skewed a bit liberal. You don’t need an exact answer here, just something directional, especially in the beginning. In a future article, I’ll provide a series of charts that show worldview splits by generation and gender.

Customers. Getting a handle on the worldview of your customers is usually fairly straightforward. However, your solution will partly depend on where your customer database is maintained. Many systems for housing customer data can provide simple customer profiles. These profiles may include indices for age, gender, and urbanicity. Some will even identify “conservative” and “liberal” as attributes.

The best proxy may be urbanicity. Just be sure you are looking at an index or other indicator that indicates higher or lower propensity than the general population. For example, more urban or inner-suburban customers will skew liberal.

The other way to understand customer worldview is to simply ask them. Execute a one-question survey and ask if they identify as liberal, moderate liberal, moderate conservative, or conservative. Frame the question so they are answering about “life” rather than politics. For example, you can ask, “What best describes your attitudes in life if you had to choose one?” Avoid including “none” as an option. Be sure the survey panel is a good representation of your customers from a geo-demographic perspective. You don’t want to choose customers just from New York City.

Opportunity

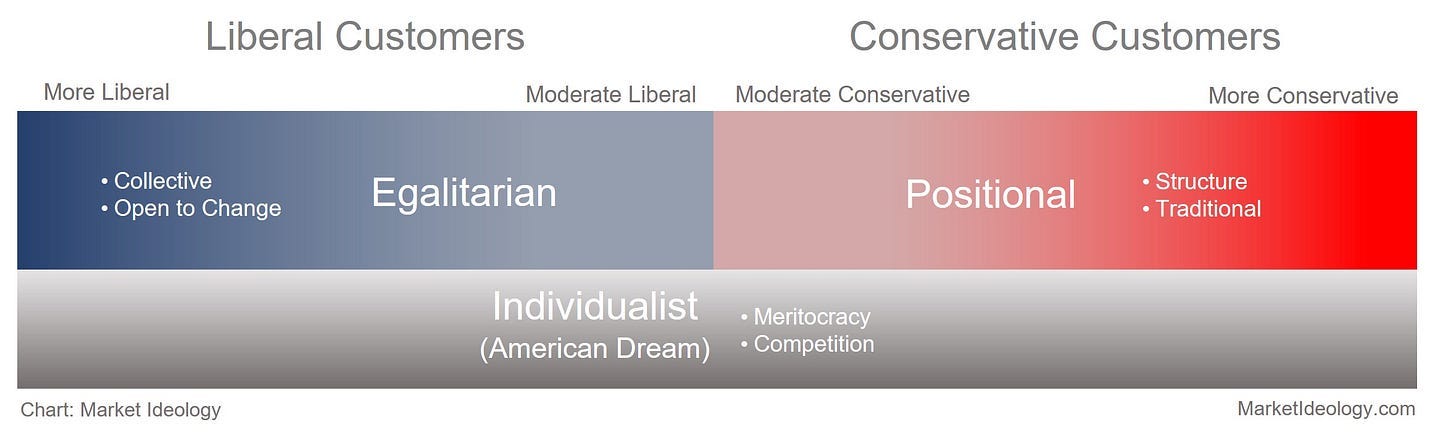

Now you’re ready to work through some strategy questions based on the assessment. Below are examples to get you started. Your exact situation may suggest other questions. Let’s start with looking at the Market and Customers.

In this example, your market and customers are aligned if you answer “Y” for yes. That leads to the potential for pushing the alignment even more to lower customer acquisition costs and grow customer value. That could involve evolution in product design, messaging strategy, media strategy, and more.

If there isn’t alignment between the market and customers, that doesn’t always mean you should fix overall alignment. The first step is understanding why there isn’t alignment by looking at the worldview skews of leadership, product, and communications. More often than not, misalignment results from chance, and sometimes that chance reveals an interesting business opportunity.

If you operate in a market with a much larger competitor, there may be reasons you want to go after the secondary worldview market. This allows you to avoid directly competing for the same customers. Going after a smaller worldview segment is also viable if you need to concentrate limited resources on a smaller market, which may also help you avoid competing directly with a larger competitor or many competitors.

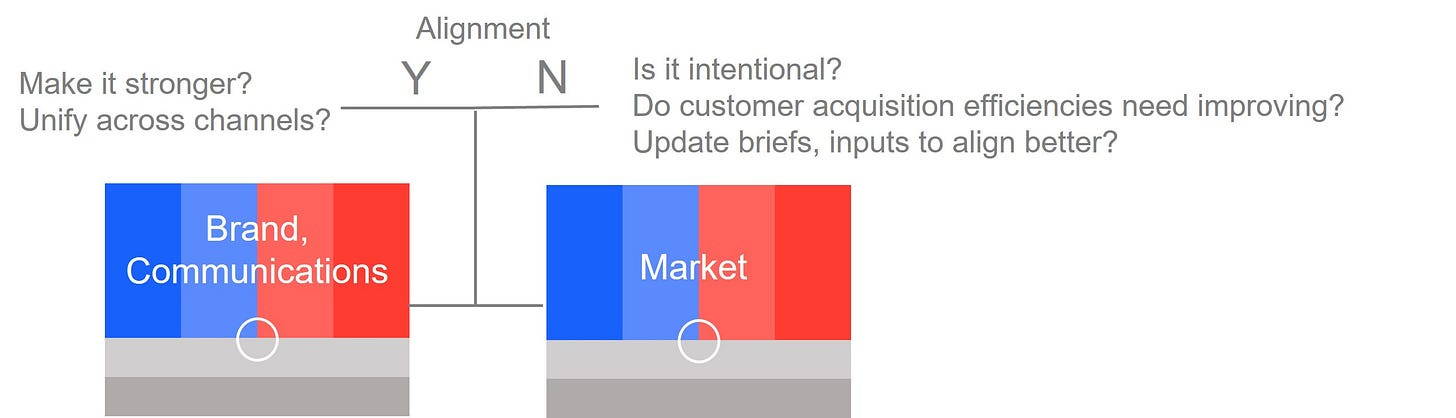

That’s one example of using the Assessment results to uncover opportunities. You can also narrow the exploration's focus to make it simpler. Here’s an example of looking at just the brand and communications with the market:

Many businesses will develop their brands and communications based on customer demographics and insights gathered in research, measures of behavior, or one-on-one interactions. However, these inputs rarely take market worldview into account. So a business, for example, that targets young suburban families will often ignore that there are two segments within that group - conservative and liberal. Each group thinks about businesses and products very differently.

When a business ignores worldview as a market attribute, it tends to create a face to the market that reflects its worldview, whether it comes from leadership or the communications professionals involved. In addition, larger organizations may tap communications partners with headquarters and staff in larger urban areas, resulting in a predisposition to project a more liberal worldview onto a market unwittingly, for better or worse.

The objective here is to have self-awareness of how the business thinks and market awareness of how customers think. Only then can stronger alignment take place. Sometimes there is good alignment that can be stronger, and there are other instances where fixing alignment is a very low-cost way of improving market efficiency. To dive deeper into two examples, check out the article on Apartments.com and Weathertech.

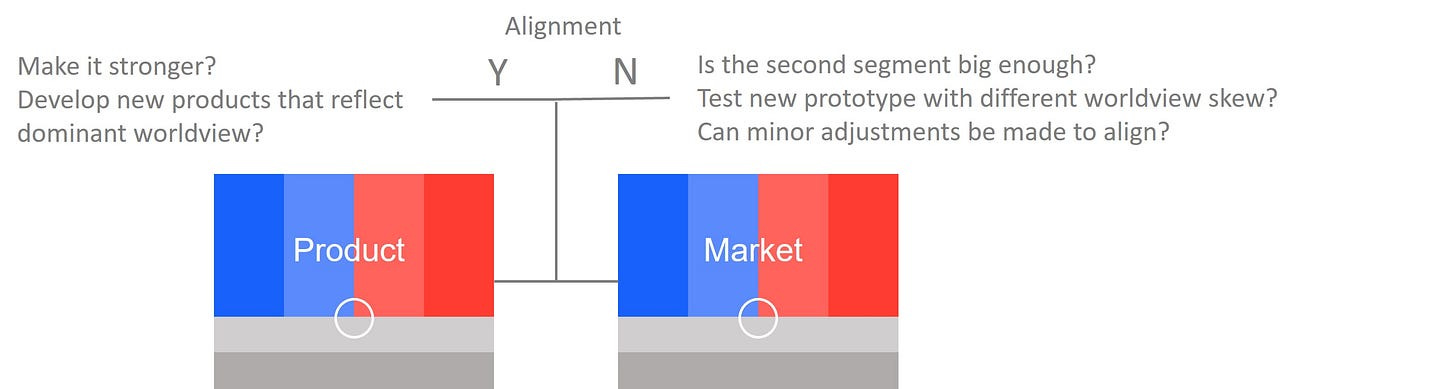

A longer-term opportunity may be to evolve the product to create stronger alignment. Here’s an example of evaluating the product relative to the market:

Aligning a product to how your market thinks can include product design or developing features that appeal to one worldview segment or the other. Depending on your product, you can execute simple surveys to uncover how the product can align better with a dominant or secondary worldview segment. The objective is for the product to have an inherent appeal to the market you want by creating a stronger fit from a worldview perspective.

Alignment

Worldview alignment can mean different things for growing a business, large or small. The key is to make it intentional rather than leaving it to chance. More often than not, there is an opportunity waiting to be revealed in this kind of analysis.

The customer model above can serve as a foundation for achieving neutral alignment or leaning into one worldview. Many distinct attributes spring from this customer model that help further define how a business can create alignment. My objective is to develop five core attributes shared across the two worldviews and twenty-five where there are distinct interpretations. Previous articles touch on distinct attributes, such as how each group thinks about the future and relationships to empathy, status, and new experiences. These will be organized into a separate framework for implementing stronger alignment.

Some businesses will have a natural tendency to want to appeal to everyone to maximize the size of the addressable market. The solution may be to fix any overall misalignment that’s not neutral. Yet that may not always be the best solution unless you represent a large national brand or have diverse retail locations.

Worldview neutrality can mean having less market fit with everyone. While your market may be very big with both worldviews, your customer acquisition costs may be higher, and your customer value may be lower because you are trying to be everything to everyone.

There are about 260 million people over eighteen in the United States. They are roughly split down the middle as conservative or liberal, including a significant portion on each side that holds a moderate worldview. Both markets are enormous, at about 130 million each. If liberal or conservative customer markets in the U.S. were a country, they would each rank number ten in the world in population.

Remaining worldview neutral or leaning into one worldview market are all viable strategies. However, some businesses will resist leaning into one worldview because it feels like they are wading into politics. That’s why it’s so important to focus on worldview, conservative and liberal, and stay away from political labels. As I’ve said before, politics is just one expression of worldview. What customers buy is another. You can get more customers to buy your products at low incremental cost by aligning with how your market thinks, which may or may not align today.